Cash flow is not the same thing as return on investment.

Cash flow is not the same thing as return on investment.

This post originally appeared on the Hermit Haus Redevelopment website on

2015-12-20.

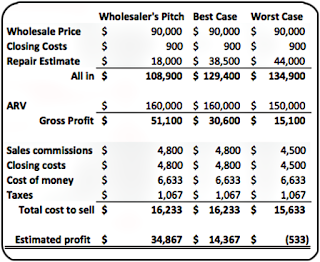

Ten days ago, I told you I would give you two examples of how to make money from rental properties and that I would use these examples in a series this series of articles. Things got busy after that, but here is the article laying out the two examples. We’ll also talk about how these two examples cash flow.

I could use real-life examples for this series, but the math would not be consistent between the examples, which could be confusing. So I’m going to use hypothetical examples for clarity. It will be much easier to get the basic principles across if the underlying assumptions are the same.

First, a couple of definitions. Investors talk of two kinds of cash flow:

- Positive cash flow

- Your rental brings in more money each month than your mortgage payment, including taxes, interest, and insurance (You don’t usually consider maintenance and depreciation at this point.)

- Negative cash flow

- Your rental brings in less money than its mortgage. (We’ll talk about why negative cash flow is not necessarily a deal breaker as this series progresses.)

|

Positive Cash Flow

|

Negative Cash Flow

|

| Purchase price |

$100,000

|

$100,000

|

| Down payment (25%) |

$25,000

|

$25,000

|

| Monthly payment |

$550

|

$550

|

| Monthly rent |

$950

|

$540

|

| Gross cash flow |

$400

|

$-10

|

It should be fairly obvious that these examples make a couple of unrealistic assumptions.

- Why pay 25% down? You don’t have to, unless you’re getting conventional financing, which is probably the only way you’d get a 5%, 30-year mortgage today.

- What about other closing costs? We’ve conveniently ignored them to keep the math simple.

- Why would anyone take on a property with a negative cash flow? Like I said, we’ll get to that.

- Negative Cash Flow

- Cash flow can be the least important reason to buy a rental property. In some cases, it can even be advantageous to buy a property with negative cash flow—that is, at least initially. In our example, losing $10 each month on rent returns about -1.9% on your initial $25,000 investment. Kinda scary, huh?

Positive Cash Flow

But let’s take a more common example, one with moderate positive cash flow. If you could rent our example house house for $950 (or $400 more than your payments), you would make $4,800 profit on that house every year, assuming no expenses other than the taxes, insurance, and interest wrapped into the mortgage payment. (It can happen easier in Central Texas than in some other markets.) That’s a 19% annual return on the $25,000 you invested to buy the house.

For some investors, that return is good enough.

Results

This negative cash flow example, could be a perfect example of applying the martial arts concept of winning by losing. Over time, the other advantages of ownership can overcome the initial cash flow deficit.

Wouldn’t it be worthwhile to lose $480 (or even $1,200) per year for five years if you would realize a $10,000 profit at sale? While we can’t say with perfect certainty that a given property will appreciate, history says it will if you can afford to hold it long enough.

What if you inherited the low rent with the property but you could increase the rent at the end of the lease? Maybe next year, the property would be able to generate $600 month without spending any more money on it. Then you’d be making $60 a month instead of losing $10. And what about inflation? Over time, inflation will probably push up the rent, but your mortgage payments won’t go up except to cover the inflationary effects on your taxes and insurance. Your cost of money is locked in for 30 years.

So the important thing is not necessarily positive cash flow today, but a cash flow you can comfortably live with knowing that it will probably improve with time.

I’ve been guilty of looking only at cash flow, and I have erroneously sold properties because of that shortsighted view. I’m focusing now on buying in growing areas where population density will increase the value of my holdings. That will improve my bottom return on investment even before I take tax reduction, appreciation, and debt reduction into account.

I’ll talk about these income streams in future articles.

Posts in this series:

-

Streams of Income from Rental Properties

- The Two Examples and Cash Flow

-

Tax Reduction Through Depreciation

-

Equity Growth