This post originally appeared on the Hermit Haus Redevelopment website on 2015-12-18.

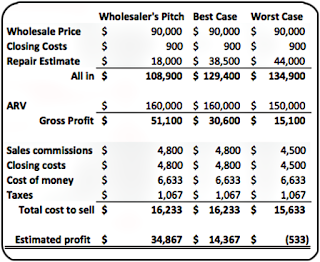

I got an email from a wholesaler today offering a property in Round Rock for $90-thousand. I performed the desktop analysis quickly and became very excited. While I couldn’t find anything that had sold on the street in the last year, two houses on the next street over had sold for just north of $200-thousand. That left a lot of room in the deal to cover whatever redevelopment the house might need.

I told the wholesaler I wanted to make an offer contingent on a walkthrough of the property. The wholesaler said we had to close by Christmas, and I agreed to the stipulation. He mentioned that he had a bid for $7,000 to cover foundation repair. Other than that, he said, all the house needed was paint.Even allowing another $5,000 to cover accidental damage to the plumbing during the foundation repair, I was still happy with the deal.

Boots Are Made for Walkin’

Russell and I met at the house during his lunch hour. The first red flag went up as I drove to the house. The comps on the next street turned out to be at least 20 years newer, and all of the houses on that street were much more appealing than any of the houses on the subject property’s street. My comps were not really comparable, but I couldn’t tell that without seeing where the main street had been extended for the newer development. Even the pictures on Google Maps made the houses look comparable.

Location, Location, ... Or Not!

On the other hand, the subject property was across the street from two schools. Location and location.

We walked the property and found that the exterior would need more than just paint. A dog had trashed the back door. Some of the eves and facia were rotten. No big problems but enough to start adding up.

Inside the house was in really bad condition, but the demo had already been started. All the carpets had been removed when a water pipe broken and flooded the house. A note on the kitchen cabinet said that repair was in process.

I won’t go into all the details, but the repair estimate came in at between $35- and $40-thousand.

To Buy or Not to Buy

When I got back to the office, Carol had run a much more accurate CMA than what I had pulled for the desktop analysis. She estimated the ARV of the house at between $140- $160-thousand. We determined that the deal was just too risky, even if we could get the house for $80-thousand. One of our mentors, Shenoah Grove, agreed. So we walked away from another property.

But the wholesaler said he had two other investors willing to take the property at full price. I wish them good luck. There are plenty of people with money to chase these deals—many of them are too willing to take on a project without fully understanding the numbers. No matter what you see on shows like Flip or Flop, those people are professionals. They almost always know what they are getting into before they buy the house, and they walk away from 20 or more deals for every project they take on.

Here is what I want you to take away from this article:

While I won’t accuse any wholesaler for outright lying, their numbers are almost always overly optimistic. This business is risky enough without walking into a deal without doing your own due diligence. Always include a contingency for unknown factors. Every project has them, but you can’t know what they are before it’s too late.

I’m going to keep my eye on this property to see what happens to it.

No comments:

Post a Comment